Less Healthy Food (LHF) advertising regulations came into force in January 2026, following voluntary adoption from October 2025. Three months of consolidated data reveal which strategies are working and where advertisers face critical ROI decisions.

Shane O’Neill, UK Director at Ebiquity, noted:

“What we are seeing in the first three months of LHF regulation is tactical adjustment alongside structural change. Brands with portfolio flexibility and strong brand assets are finding ways to protect reach and efficiency, while others are reassessing the role of linear TV altogether. The regulation has accelerated decisions many advertisers were already deferring.”

What the LHF regulation changes in practice

The legislation bans non-LHF compliant ads from running pre-9pm on linear TV and Ofcom-regulated VoD, alongside a blanket restriction on other video and digital channels (with some exemptions).

To protect yield on late peak inventory, broadcasters were set to charge a premium of +30 to +50% on existing TV pricing for campaigns running 9pm only.

Copy Swap Strategies Dominate Early Response

“Copy swap” was a solution proposed by the broadcasters, allowing advertisers to protect their previous trading terms by running compliant creatives pre 9pm and non-compliant ads after 9pm.

Where an advertiser has a product range or non LHF-specific brand, copy swapping allows the advertiser to avoid paying premiums. Supermarkets and range advertisers have effectively used this approach. Their ability to do so reflects portfolio breadth and brand architecture, allowing compliance without materially undermining brand presence. In the soft drink sector, our analysis revealed that brands had been running their ‘zero’ creative during the day, before switching to their full sugar version post watershed.

It can be more difficult for confectionery brands, but creative solutions have been employed in places. One chocolate advertiser aired pre-9pm creative with the product entirely removed, relying on branding recognition and implicit associations. This approach demonstrates the creative flexibility available to established brands with strong visual equity or sonic branding.

Premium Pricing Drives Category Exits from Linear TV

Copy swapping is not feasible for everyone however. If an advertiser doesn’t have an LHF compliant product to feature pre 9pm, there may be little value to this approach.

Weight of advertising on linear TV was down 7% year on year across the period as a whole, but much sharper declines were recorded in the confectionery & snacks sector (-61%) and the Frozen Food sector (-72%), the categories most affected by the LHF legislation. Early evidence suggests these are not short-term pauses, but deliberate reallocations away from linear TV where compliance and cost pressures are hardest to absorb. Five of the top twelve heaviest advertising confectionery & snacks brands from Oct-Dec 2024 were not active on linear TV across Oct-Dec 2025 at all.

Late Peak Inventory Maintains Reach Efficiency Despite Restrictions

As a result of the high adoption rate of copy swaps and affected sectors buying less TV, we haven’t yet seen sustained pressure on late peak. But it’s likely there will be shorter occasions of congestion, particularly on key weekends running up to Christmas and Easter.

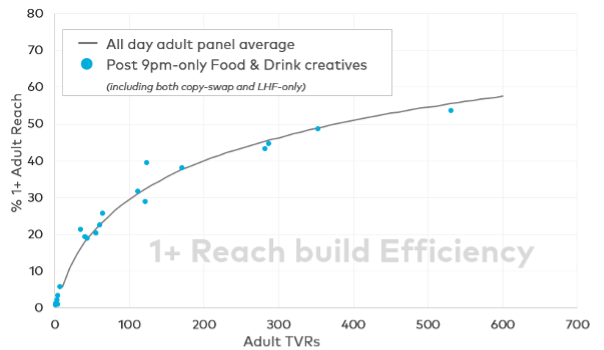

But for those brands limited to post 9pm airtime only, there is some good news. Reach still builds efficiently per rating in this daypart relative to ‘all time’ TV, given the naturally lighter viewership that tunes in for late peak viewing (see chart below). So, the audience is still there, but pricing premiums alter affordability and achievable scale.

Broadcaster VoD & Ofcom-regulated CTV benefit

While streaming platforms lack Barb’s measurement granularity, the digital blackout (from which BVOD is excluded) positions BVOD as the most logical beneficiary of redirected LHF investment. Post-9pm restrictions apply, but pricing premiums remain less prevalent than linear. Linear broadcaster spends had already been migrating to BVoD; LHF will likely have accelerated that process.

YouTube continues to expand its Ofcom-regulated inventory too, recently announcing a content partnership with BBC (to add to those already in place with other broadcasters).

Strategic implications

Advertiser responses will solidify throughout 2026, creating winners and losers in media efficiency. Three actions separate leaders from followers:

- Continuous ROI measurement across the fragmented video landscape is no longer optional. Brands lacking granular effectiveness data cannot optimise in this environment.

- Post-9pm reach remains available across linear and BVoD, but execution quality determines outcomes. Weak buying practices (for example, poor targeting or low quality station mix) will erode margins quickly.

- Governance frameworks must extend beyond traditional TV. Streaming and VoD require the same rigour as linear planning, yet few advertisers have established this capability.

LHF regulation is already changing how brands approach the role of TV in the UK. Some advertisers are adapting through creative and trading flexibility, while others are reducing or exiting linear altogether. Regulatory shifts like this tend to accelerate decisions that were already under debate, and quickly expose gaps in governance, measurement and trading capability.

Ebiquity combines the UK’s most comprehensive cross-platform measurement with three decades of broadcast trading expertise and has guided advertisers through every major regulatory shift in UK media. For many advertisers, the focus is now on how confidently their video investment can adapt to this new reality.