The battle against coronavirus still has a long way to run, but the impact of the pandemic on economies around the world has been neither as severe or as deep as many predicted. The global economy is set to recover during 2021. Ad spend will track and help drive the recovery, with advertisers decreasingly tolerant of wastage and looking to enhance both ROI and value generated by their media investments. This is in the context of new data suggesting that, in the U.K. alone, brands risk leaving as much as £90bn of shareholder value – and probably more – on the table by failing to optimize media investment, thanks in part to over-investment in search.

In media and tech, there are likely to be changes in who dominates the market, driven by consumer behaviour and government regulation. The e-commerce bounce experienced in the wake of lockdowns across the world in 2020 is benefitting more retailers than just Amazon, and both Netflix and sports rights face significant medium-term challenges.

These were the conclusions of Ian Whittaker, founder of Liberty Sky Advisors, in a webinar hosted by Ebiquity this week. This article summarizes Ian’s main arguments and data.

Macroeconomic themes

Global stock markets have a tailwind that should propel recovery and growth during 2021. The S&P 500, Shanghai Composite, and Nikkei 225 are all currently trading ~20% higher than the average of the past year. Stock market performance will continue to be strong, thanks to consumers’ willingness to spend, improving business sentiment, and high levels of debt in the market – particularly from government stimulus packages.

Companies around the world are beating city expectations, including Target and Next in retail, Morgan Stanley in financial services, and Procter & Gamble and Unilever in FMCG. Indeed, twice during 2020 P&G had to revise its sales forecasts as earnings exceeded expectations, reinvesting much of this in marketing to drive further growth.

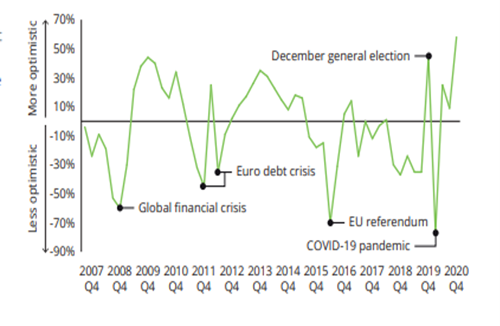

Confidence in economic prospects is also improving. Business optimism is returning for both CFOs and CEOs, according to regular health checks from Deloitte (Figure 1.) and McKinsey. This is in part thanks to the roll-out of vaccine programmes around the world, in part as a result of economic recovery. While the U.S. is expected to back to pre-pandemic levels by Q4 2021, China is likely to outperform expectations, sustaining its record of positive growth experienced in Q2-Q4 2020. Consumer sentiment lags behind business confidence, with restrictions on freedom to travel and work still in place in many markets. Increasing consumer debt may also slow the return of positive sentiment.

Figure 1. Business optimism on the rise (source: Deloitte UK CFO Survey, Q4 2020)

Advertising

As economic performance improves, brand investment in advertising is expected to track growth and recovery post-pandemic (see Figure 2.). COVID has accelerated the blurring of the lines between traditional and digital media. Increasing digitization of media – from broadcaster video-on-demand to digital out-of-home – means that more than half of all investment in TV and billboards will be digital by 2025. Cross-platform optimization is leading to more, more impactful integrated campaigns, increasingly outperforming stand-alone media buys.

Figure 2. Economic growth and advertising (source: GroupM)

The structural drivers of growth in the advertising market are good, suggesting strong performance in the years ahead. These include:

• New advertisers and new business models coming into the market, from pharma to media streaming services

• Money saved – from brands’ reduced investment in property (fewer employees in offices and for less time) and travel – shifted into advertising

• The increase in e-commerce requiring brands to upweight spend to sustain awareness and mental availability in consumers’ minds

• The growth of Q-commerce – small warehouses in urban areas for quick delivery stocking a limited number of brands. Those brands with a strong presence will trigger both listings from Q-commerce providers and consumer demand

Alongside increased ad spend, advertisers will also be looking to drive increased shareholder value. According to a new analysis to be published in February 2021, up to £90bn in shareholder value could be lost in the U.K. by 2025 because of unoptimized spend. This is because of (i) leakage in the digital media ecosystem, (ii) brands investing 60% in activation and only 40% in brand building, the exact opposite of Binet and Field’s recommended ratio, and (iii) over-investment in search. Never designed to be a brand building tool, search typically commands more than 30% of ad spend on search, while evidence shows that more than 20% is too much. Note that this £90bn does not take Into account the “lost opportunities” from sales never realised because advertising spending has been misallocated so It Is likely to be a – very – conservative estimate.

Trends in the media and tech

In the media landscape, the roll-out of 5G is unlikely to have a significant impact in the medium term, and this will be evident in B2B but not consumer brands for some time. In the year ahead, consumers will increasingly be required to choose between premium, subscription models that are ad-free or free services that are funded by advertising – Netflix vs YouTube, Apple vs Android, paid-for games vs free games. Consumer pressure for personal data to be protected has already resulted in a growing wave of regulation and legislation – from GDPR to the CCPA, spreading to India and most recently Australia. Governments flexing their muscles against Big Tech is a trend that looks set to continue.

Much has been written about the explosion of e-commerce under the pandemic, and although Amazon was in a strong position in many markets to capitalize on this, the e-commerce boom has benefitted many retailers. Indeed, many bricks-and-mortar retailers, including Target and Wal-Mart, have enjoyed stronger growth in e-commerce than Amazon. They have used the opportunity to accelerate e-commerce offers and also use their physical presence – which Amazon lacks – to drive online performance with “click and collect”.

The rise and rise of Netflix may be coming to an end, with content creators – most notably Disney – launching rival, direct-to-consumer offers and withdrawing their premium content from Netflix, quickly building rival platforms with tens of millions of subscribers. Another area of concern is sports. For the first time in many years, the revenues generated by licensing of the English Premier League around the world are falling as audiences start to favour dramatic and factual content offered by cheaper streaming services.

Ian Whittaker is the founder of Liberty Sky Advisors. He has been a city analyst and head of media for 20 years and is a two-time winner of City AM’s Analyst of the Year. He is recognised for his industry knowledge across all areas of media and has a proven track record of being ahead of the curve in understanding industry dynamics and what these mean for advertisers. You can reach Ian at Ian.whittaker@liberty-sky-advisors.com ; ianrwhittaker@gmail.com