Maintaining share of voice is critical for advertisers during a recession, both to stay front of mind among consumers in a downturn, and in order to position their brands in an optimal way for the recovery.

Christian Polman, discussed this subject at an online event convened by the Advertising Research Foundation (ARF), the trade body.

Christian said, “Market share performance is related to share of voice … That applies in a recession as well”. (For more, read WARC’s in-depth report: Why brands that maintain share of voice in a recession will build long-term equity.)

Christian further noted that not just maintaining but increasing adspend in such periods of disruption can lead to “substantially higher market share” in the post-crisis period.

There is a considerable body of research in support of this claim, with Polman citing the example of a PIMS (Profit Impact of Market Strategy) Database analysis.

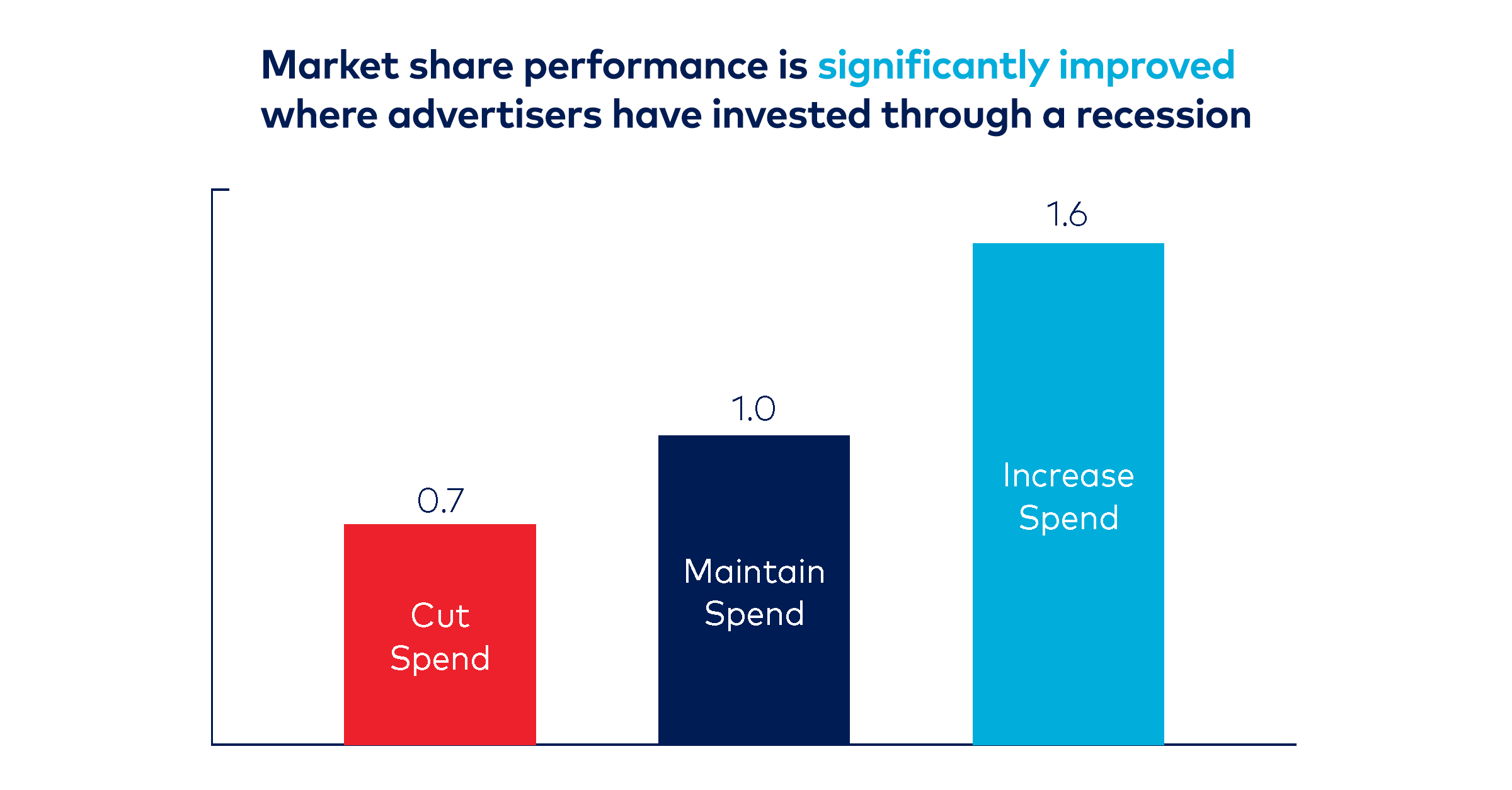

According to this research, advertisers that boosted spending levels in a recession gained 1.6 percentage points in market share in the first two years of a recovery.

That figure stood at one percentage point for enterprises that maintained their ad investment, and fell to 0.7 percentage points for the organisations that cut their outlay.

Source: PIMS – the Profit Impact Marketing Strategy database, https://www.inc.com/encyclopedia/profit-impact-of-market-strategies-pims.html

“There will be certain sectors where maintaining spend will be out of the question,” Christian admitted, citing the travel industry as an example.

“But, for those who can afford it, there’s logic in trying to at least maintain spend – if not increasing [it] – when we look at data from the past.”

Ebiquity launched last week their latest viewpoint ‘Advertising through a recession‘, you can download your complimentary copy, here.

To read the article in full in WARC, please click here.

First featured on 13/04/2020.