Netflix has officially followed the Disney+ announcement and confirmed that they will be launching an ad-funded tier, which will be ‘coming soon’.

During an interview in Cannes, Ted Sarandos, the company’s Chief Executive stated “We’re adding an ad tier for folks who say, ‘Hey, I want a lower price and I’ll watch ads.”

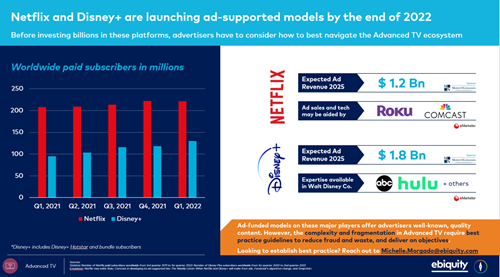

This is a considerable development, particularly as the AVOD platforms are in both consumption and ad revenue growth. Recent eMarketer figures show in the US 41.6% of the population are using AVOD services this year so far and time spent with CTVs is approaching 2 hours per day. With Netflix and Disney+ entering the ring, these figures are expected to increase. CTV AD Revenue is forecast to increase to $23.90b in 2023, a 26.5% increase vs 2022 with expectations to hit $38.83 in 2026. This will shift the linear/CTV spend profile from 22% CTV in 2022 to 37% in 2026! Looking specifically at forecasted ad revenue reports by MoffettNathanson for Netflix and Disney+, Netflix is predicted to hit $1.2B and Disney+ $1.8B by 2025.

There are ongoing debates in the market regarding where these CTV budgets will come from; will budgets be rerouted from linear, OLV, or display? Ultimately, it is highly likely to be a mixture of all three but with ongoing pressures of high TV inflation, specifically in the UK, we could see a chunk coming out of linear.

A consideration for Netflix in its journey into AVOD is its tech and ad sales infrastructure and are already exploring potential partnerships with Google. There are also rumours that they are considering buying Roku due to advertising tech, relationships, scale, expertise, and traction in this space. Whereas Disney+ has access to existing ad infrastructure and learnings from the success of Hulu, which will allow Disney+ to, potentially, go to market earlier than Netflix and with their best foot forward!

With premium streaming platforms, such as Netflix and Disney+, moving into AVOD, it gives advertisers the opportunity to include well-known, trusted platforms and content to Advanced AV plans, in an ecosystem that has become exceptionally fragmented – no doubt that this is a welcomed development by many. However, measurement and transparency remain ongoing issues. We advise all advertisers who have Advanced TV on their media plans to ensure best practice guidelines are implemented to reduce fraud, deliver within quality inventory and platforms and give clarity of the execution. The industry desperately needs measurement in this space and without this resolved, it could slow growth potential.

Ad-funded models on these major players offer advertisers well-known, quality content. However, the complexity and fragmentation in Advanced TV requires best practice guidelines to reduce fraud and waste and deliver on objectives.

Want to establish best practice? Reach out to Michelle Morgado