As appeared in Marketing Brew on 18 July 2022, read here.

Advertisers are spending roughly a tenth of their budgets on clickbait sites, according to a new report.

Working alongside brand suitability firm DeepSee and ad-tech consultancy Jounce Media, media-research company Ebiquity found that its clients had spent about $115 million between January 2020 and May 2022, enough to buy some of the most expensive real estate in New York City, on something the industry calls “made for advertising” inventory, aka clickbait sites that exist for the sole purpose of siphoning ad budgets.

- That’s roughly 7.8% of the $1.47 billion that 42 clients spent on programmatic display and video ads across 5,490 unique made-for-advertising domains, Ebiquity told Marketing Brew.

- Ebiquity’s US clients spent an average of 9.8% of their budgets on clickbait.

- Though they declined to name clients, according to Ebiquity’s website, the company has worked with brands like L’Oréal, Sony, Nestlé, Subway, and Audi.

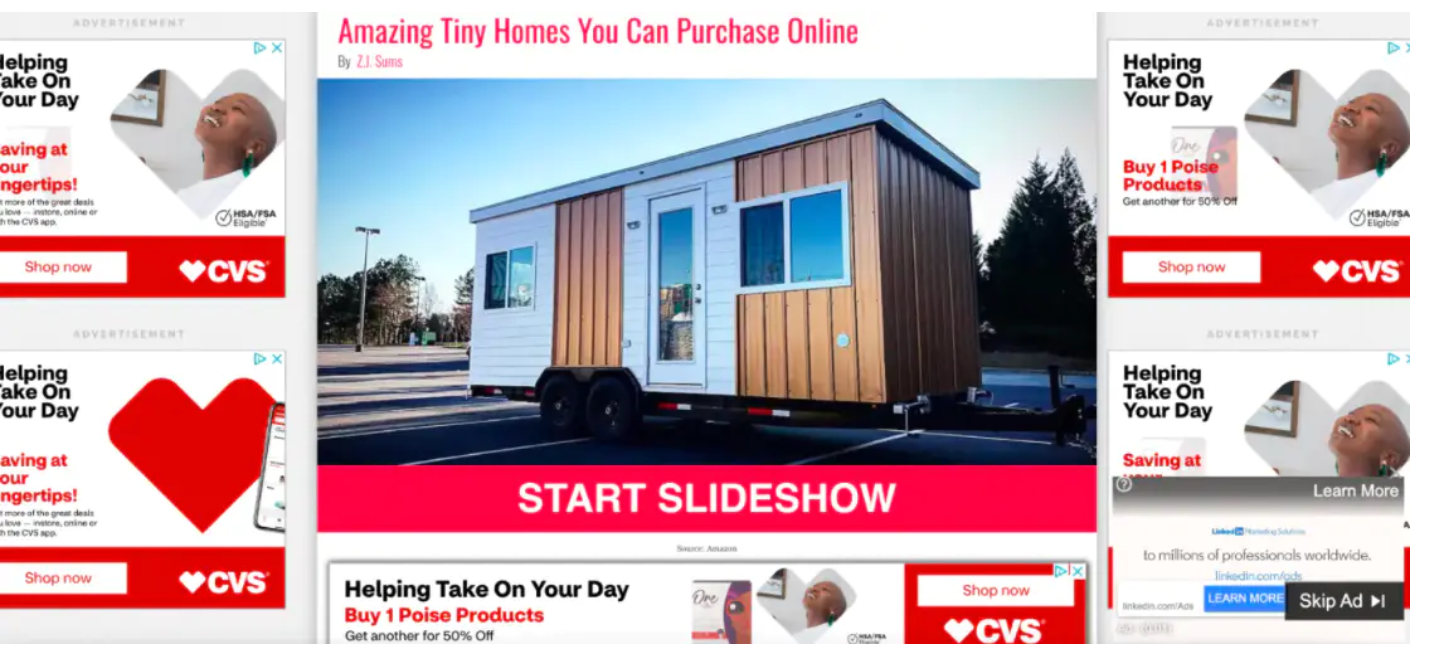

Though on paper (or in a spreadsheet, more realistically), these sites read as cheap with low CPMs and high viewability, few advertisers would ever deliberately buy inventory that looks like this:

example of what a “made for inventory” site looks like, featuring CVS ads.

Those dollars could have gone to “media companies with a diverse ownership profile…high-quality journalism or high-quality news publications,” Ruben Schreurs, chief product officer at Ebiquity, told Marketing Brew, as opposed to companies that have “no value to society.” As for how to avoid this, Schreurs suggested leaning on exclusion or inclusion lists, which can be easier said than done.

“It’s so blatant, it’s such a big number, we feel it’s a prerogative for brands to make sure that they address this,” he said. “Exclude this activity and make the effort to understand which properties are misbehaving.”

Download Ebiquity’s guide: Tackling Responsible Media here.